Mortgage Assumption Regulations . an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a home loan that can be transferred from the seller to the buyer, avoiding higher interest rates. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate.

from www.lendingtree.com

an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is a home loan that can be transferred from the seller to the buyer, avoiding higher interest rates. an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment.

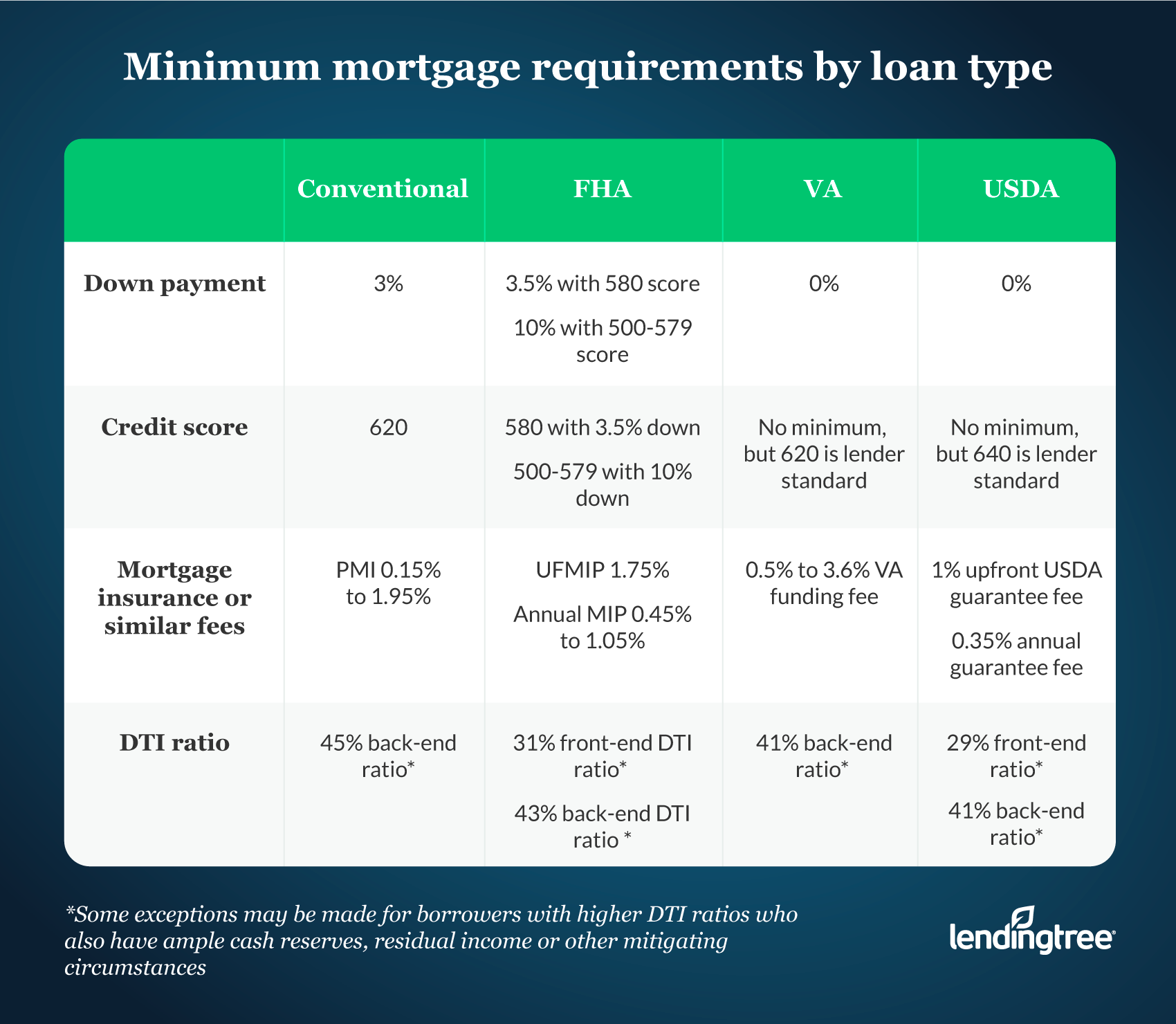

2021 Minimum Mortgage Requirements LendingTree

Mortgage Assumption Regulations an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. an assumable mortgage is a home loan that can be transferred from the seller to the buyer, avoiding higher interest rates.

From www.scribd.com

Sample Mortgage Assumption Agreement Form Mortgage Law Loans Mortgage Assumption Regulations learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest. Mortgage Assumption Regulations.

From www.signnow.com

ASSUMPTION AGREEMENT MORTGAGE Form Fill Out and Sign Printable PDF Mortgage Assumption Regulations an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage is a home loan that can be transferred from the seller. Mortgage Assumption Regulations.

From www.scribd.com

Deed of Sale With Assumption of Mortgage PDF Mortgage Law Land Law Mortgage Assumption Regulations an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage allows the buyer to take over the seller's loan, which may. Mortgage Assumption Regulations.

From getapprovedlenders.com

Requirements for Conventional mortgage Let's Find Out Mortgage Assumption Regulations an assumable mortgage is a home loan that can be transferred from the seller to the buyer, avoiding higher interest rates. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. learn how to assume a mortgage and take over an existing loan with low interest rate from. Mortgage Assumption Regulations.

From www.scribd.com

Mortgage Assumption Agreement PDF Notary Public Mortgage Law Mortgage Assumption Regulations an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a home loan that can be transferred from the seller to the buyer, avoiding. Mortgage Assumption Regulations.

From enterstarcrypticcity.blogspot.com

Mortgage Assumption Agreement Sample PDF Template Mortgage Assumption Regulations learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. an assumable mortgage is a home loan that can be transferred from the seller to the buyer, avoiding. Mortgage Assumption Regulations.

From www.scribd.com

Assumption of Mortgage PDF Assignment (Law) Mortgage Law Mortgage Assumption Regulations an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. learn what an assumable mortgage is and which types of loans are assumable, such as. Mortgage Assumption Regulations.

From www.sampletemplates.com

FREE 12+ Sample Mortgage Agreement Templates in PDF MS Word Google Mortgage Assumption Regulations an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a home loan that can be transferred from the seller to. Mortgage Assumption Regulations.

From www.scribd.com

Mortgage Assumption Agreement (Original Mortgage Holder Released from Mortgage Assumption Regulations an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. learn what an assumable mortgage is and which types of loans are assumable, such. Mortgage Assumption Regulations.

From www.youtube.com

Mortgage Assumptions Explained 3 Things You Should Know YouTube Mortgage Assumption Regulations an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a home loan that can be transferred from the seller to. Mortgage Assumption Regulations.

From www.signnow.com

Assumption Agreement of Mortgage and Release of Original Mortgagors Mortgage Assumption Regulations an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. an assumable mortgage is a home loan that can be transferred from the seller to. Mortgage Assumption Regulations.

From www.template.net

8+ Assumption Agreement Templates Free Sample, Example Format Download Mortgage Assumption Regulations learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest. Mortgage Assumption Regulations.

From www.lendingtree.com

2021 Minimum Mortgage Requirements LendingTree Mortgage Assumption Regulations an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and usda. learn how to assume a mortgage and take over an existing loan with low interest rate from a. Mortgage Assumption Regulations.

From www.uslegalforms.com

Florida Assumption Agreement of Mortgage and Release of Original Mortgage Assumption Regulations learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. learn what an assumable mortgage is and which types of loans are assumable, such as fha, va and. Mortgage Assumption Regulations.

From www.template.net

Assumption Agreement Templates 9 Free Word, PDF Format Download Mortgage Assumption Regulations learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually. Mortgage Assumption Regulations.

From enterstarcrypticcity.blogspot.com

Mortgage Assumption Agreement Sample PDF Template Mortgage Assumption Regulations learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. an assumable mortgage allows the buyer to take over the seller's loan, which may offer. Mortgage Assumption Regulations.

From www.formsbirds.com

Mortgage Assumption Agreement Free Download Mortgage Assumption Regulations an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the same interest rate and repayment. learn how to assume a mortgage and take over an existing loan with low interest rate from a seller. learn what an assumable mortgage is and which types of loans are assumable, such as. Mortgage Assumption Regulations.

From www.dreamstime.com

Mortgage Assumption Agreement Stock Image Image of document, bank Mortgage Assumption Regulations an assumable mortgage is when a new borrower takes over an existing borrower’s mortgage, usually with a lower interest rate. an assumable mortgage allows the buyer to take over the seller's loan, which may offer a lower interest rate. an assumable mortgage is a loan that can be transferred from the seller to the buyer, keeping the. Mortgage Assumption Regulations.